What They |

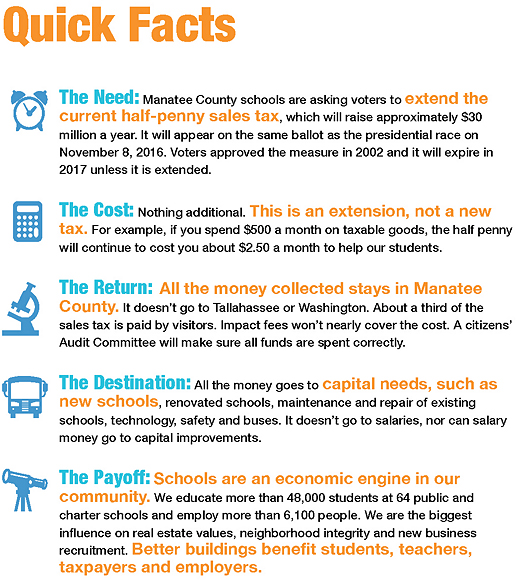

The school sales tax revenue for the first year is $30 million, but that will increase to a total of over a half-billion dollars over fifteen years. The existing tax will expire at midnight on December 31, 2017. |

They don't tell us that the tax applies to goods AND services so if you go in to get your car fixed and it costs $500 including parts and service, you pay the tax on the whole amount. If you get your car washed, you pay sales tax on that even though you don't get any "goods". It is very misleading to think that you would spend only $500/month. |

Where did they get that 1/3 number? Where is their empirical proof that "a third of the tax is paid by visitors"? And, what makes them think that a "citizens' committee" will have any influence when the oversight committee for the present sales tax was disbanded after most members resigned because of lack of cooperation of the school district? |

Revenue may be used for capital needs including capital needs required ONLY BECAUSE OF NEW DEVELOPEMENT. In other words sales tax revenue MAY BE USED TO COMPENSATE FOR NON-COLLECTION OF IMPACT FEES. Without restrictions, you can be sure sales tax revenue will be used to compensate for non-collection of impact fees - just as it is now. Also, sales tax revenue may be used as collateral to borrow even more money - just as they are doing now. |

We want great schools that benefit our kids, our teachers, and our community; but we don't want our tax dollars going to subsidize any interest group including the developers. |